Additional

Additional

Lesson 15 : Inside Day

Lesson 15 : Inside Day

Lesson 15 : Inside Day

Advanced

Advanced

Advanced

2 min

2 min

2 min

Bias Following Inside Day

Bias Following Inside Day

Bias Following Inside Day

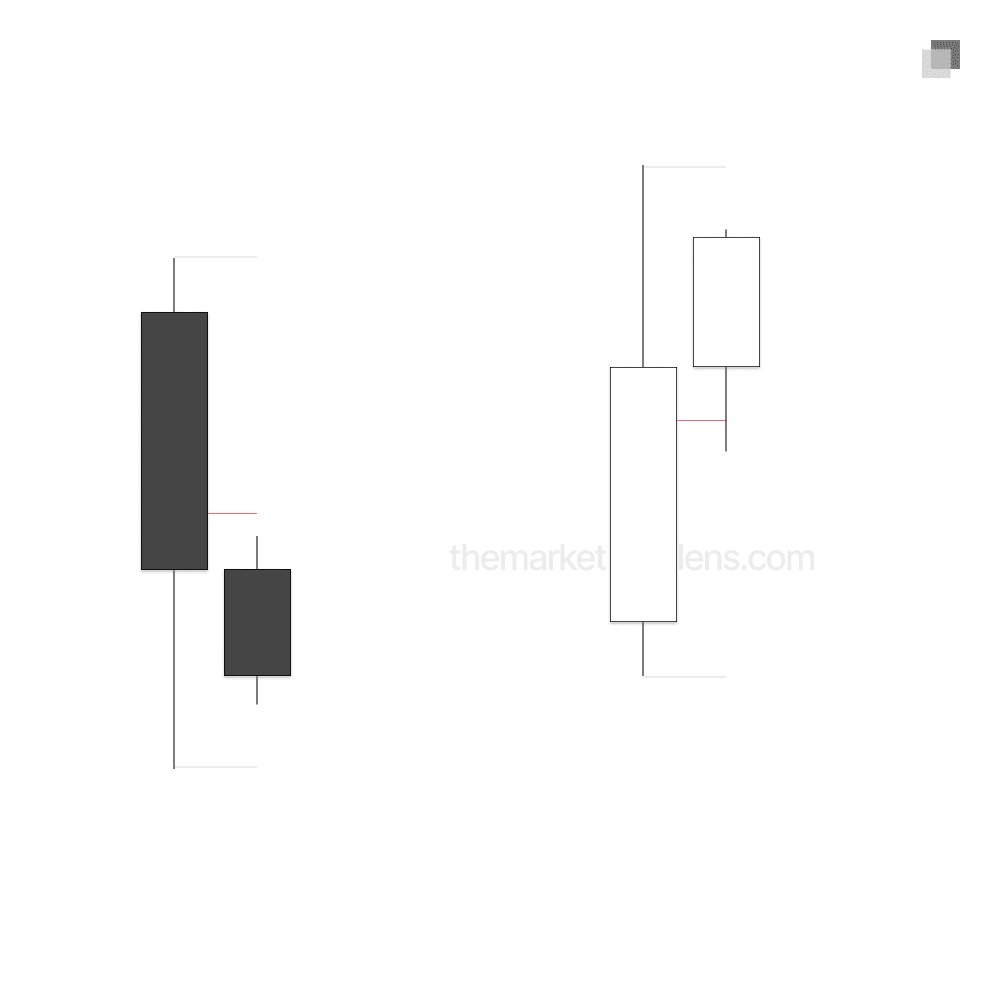

Mechanically, when price forms an inside day, there are no closures to base the next day’s movement on. In these cases, equilibrium can be applied as a tool for anticipation. This is an advanced concept meant for specific scenarios, as consolidation can occur. By marking out the previous day’s range that the current day stayed within, you then check whether price respected the EQ or not. If price respects the EQ, continuation can be anticipated. If price fails to respect the EQ, a reversal is more likely.

Mechanically, when price forms an inside day, there are no closures to base the next day’s movement on. In these cases, equilibrium can be applied as a tool for anticipation. This is an advanced concept meant for specific scenarios, as consolidation can occur. By marking out the previous day’s range that the current day stayed within, you then check whether price respected the EQ or not. If price respects the EQ, continuation can be anticipated. If price fails to respect the EQ, a reversal is more likely.

Mechanically, when price forms an inside day, there are no closures to base the next day’s movement on. In these cases, equilibrium can be applied as a tool for anticipation. This is an advanced concept meant for specific scenarios, as consolidation can occur. By marking out the previous day’s range that the current day stayed within, you then check whether price respected the EQ or not. If price respects the EQ, continuation can be anticipated. If price fails to respect the EQ, a reversal is more likely.

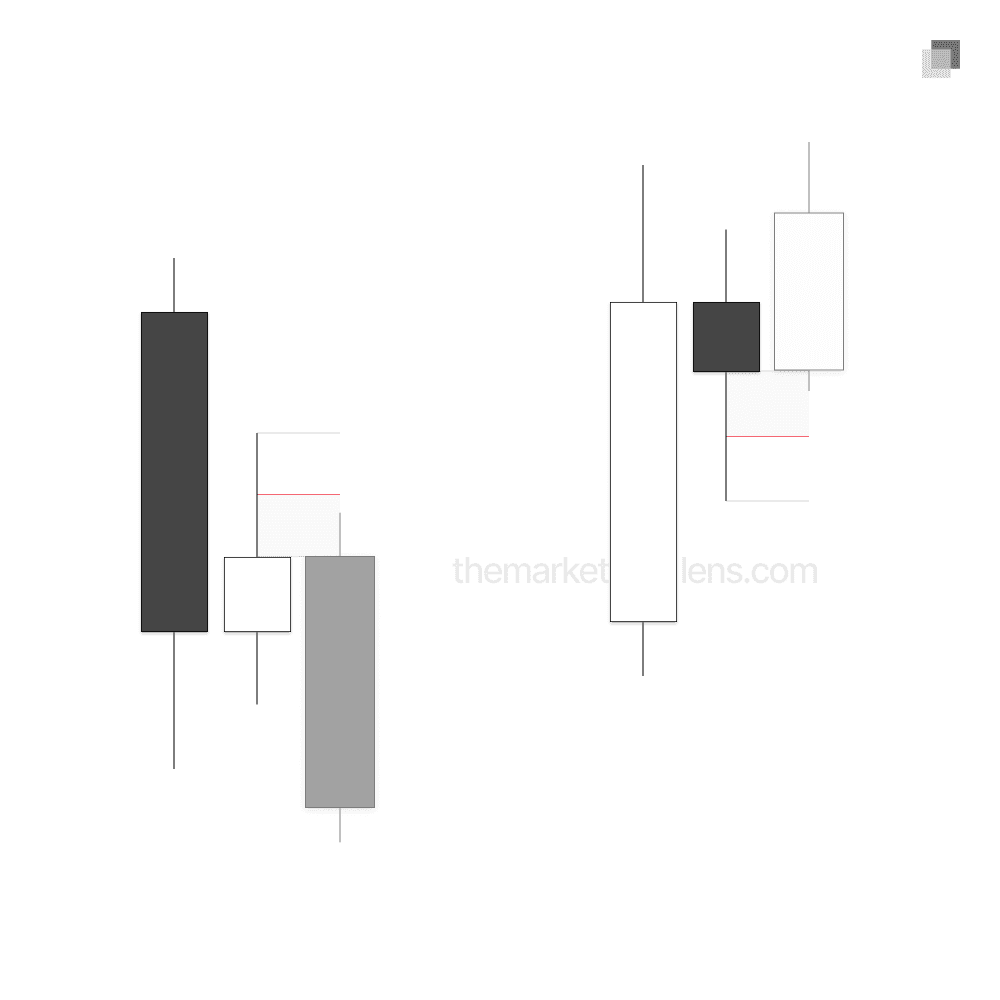

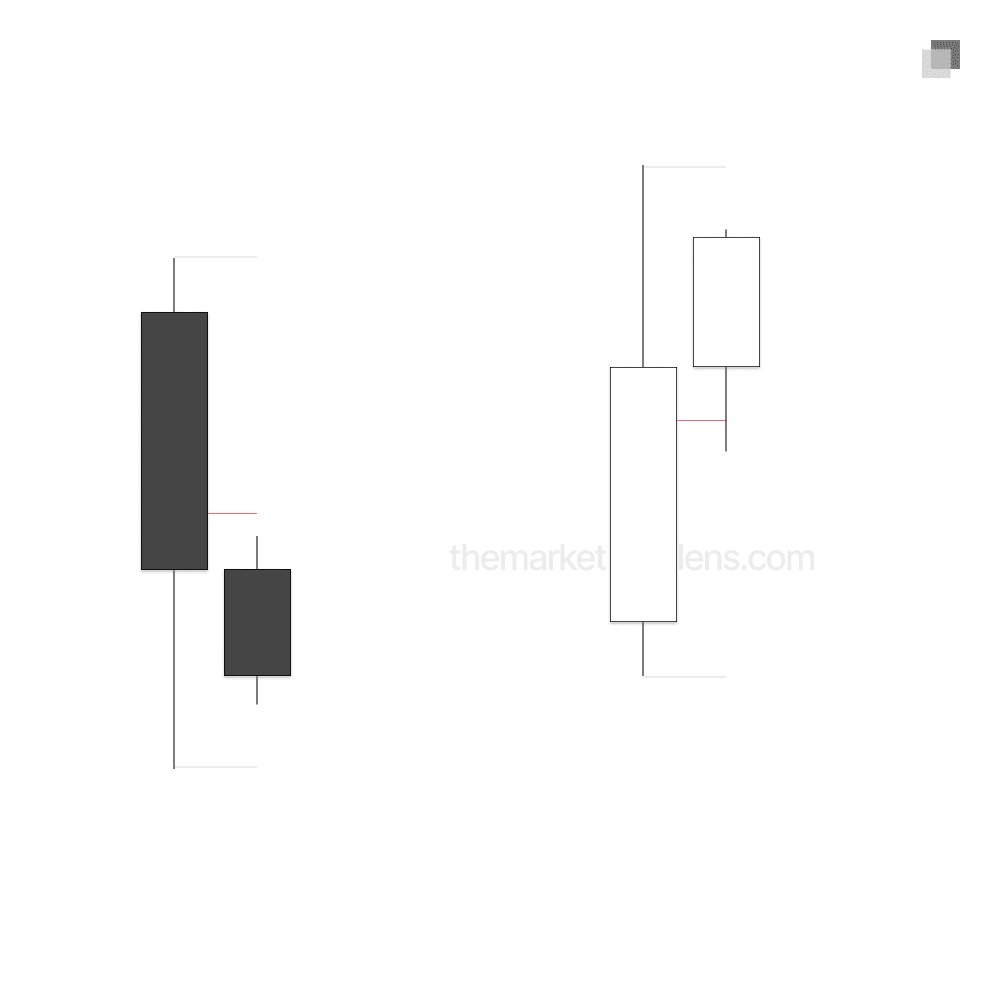

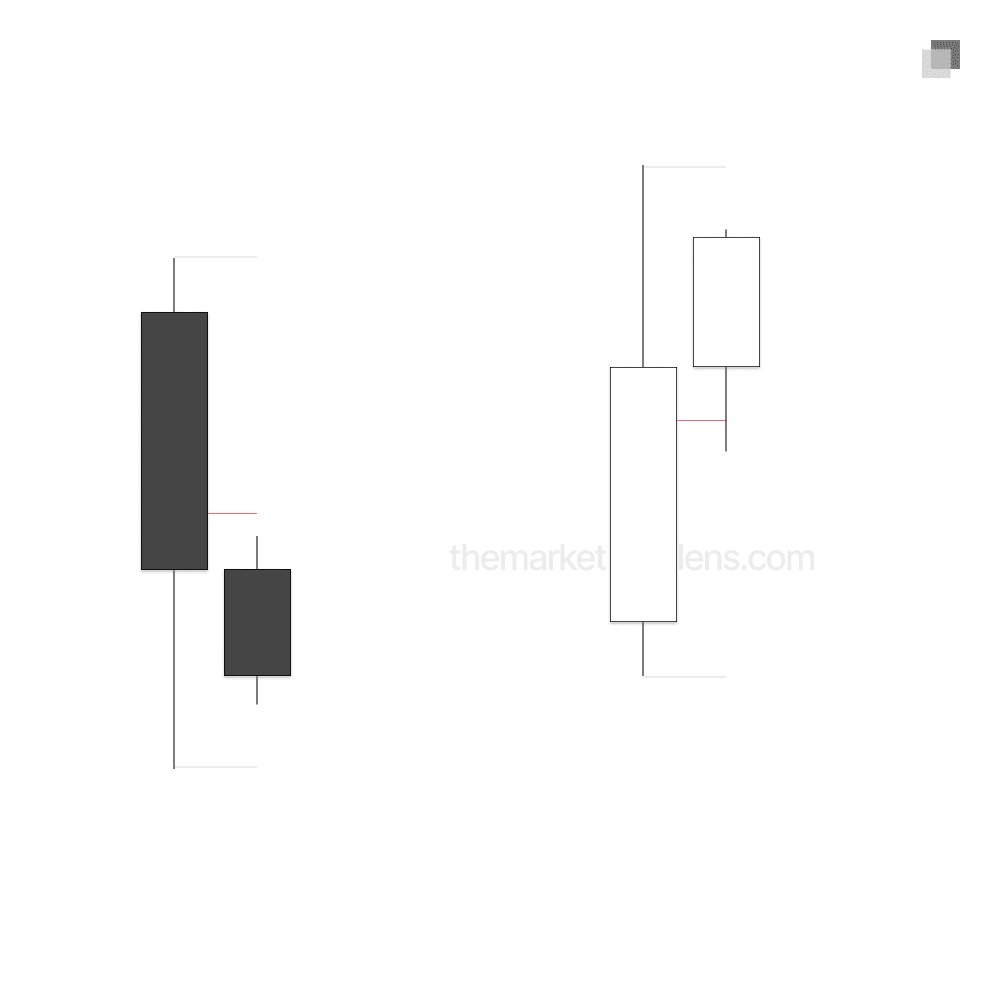

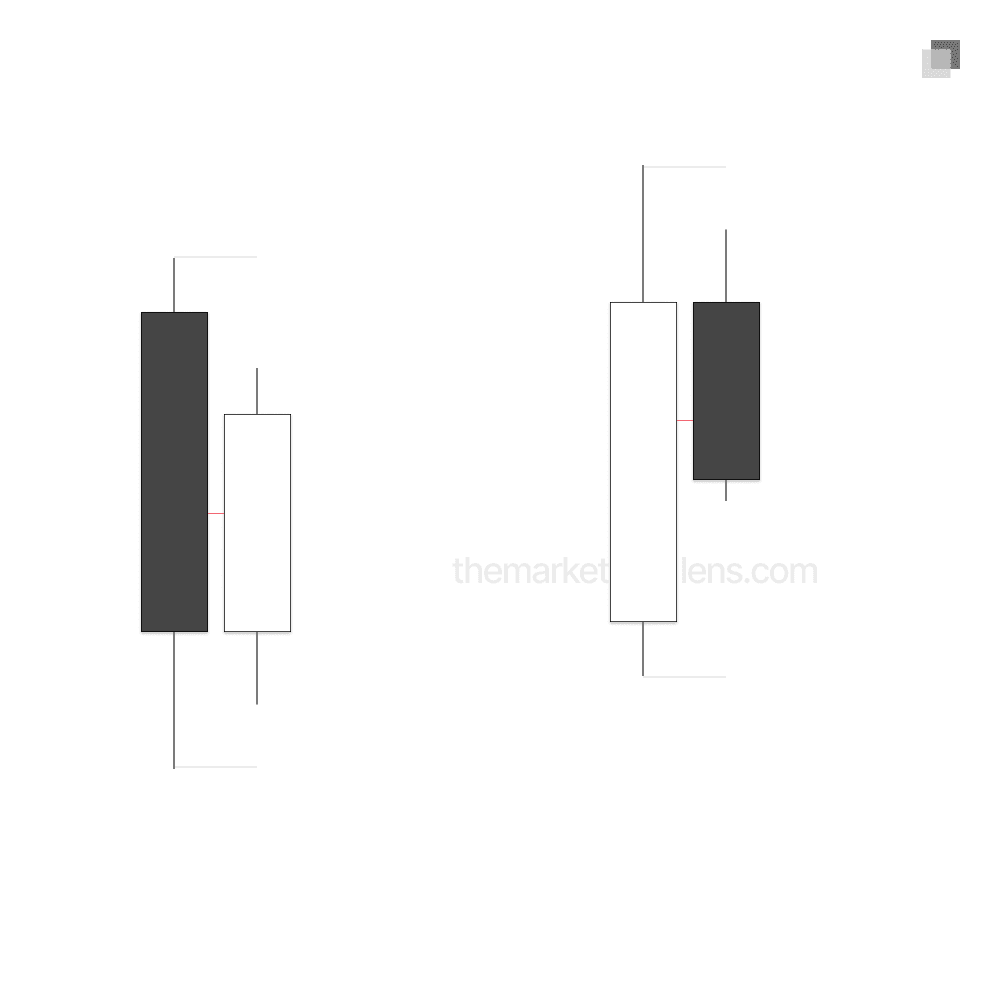

In this example, price remains in respect to the EQ of the prior day’s range. This signals a continuation in the direction of the first day. Since the inside bar closes on its wick, use 0.5 of that wick as the reference point to look for continuation the following day.

In this example, price remains in respect to the EQ of the prior day’s range. This signals a continuation in the direction of the first day. Since the inside bar closes on its wick, use 0.5 of that wick as the reference point to look for continuation the following day.

In this example, price remains in respect to the EQ of the prior day’s range. This signals a continuation in the direction of the first day. Since the inside bar closes on its wick, use 0.5 of that wick as the reference point to look for continuation the following day.

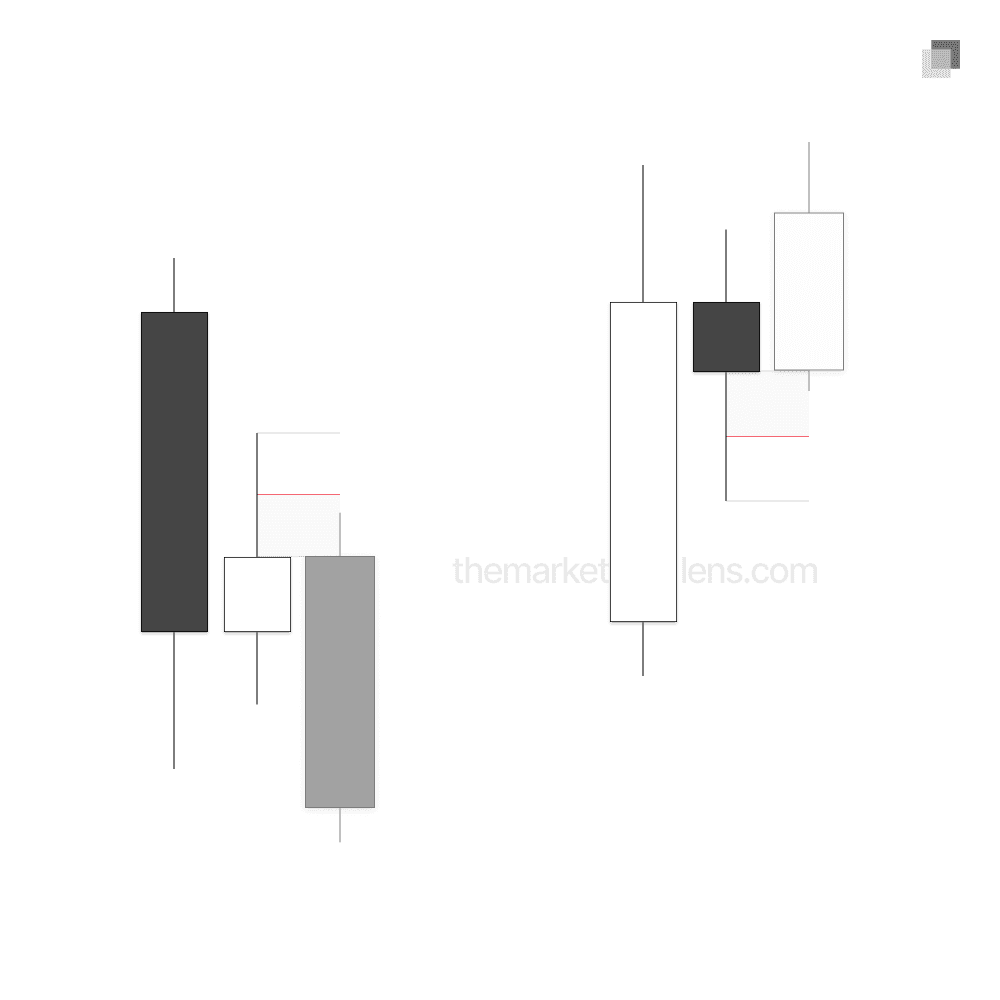

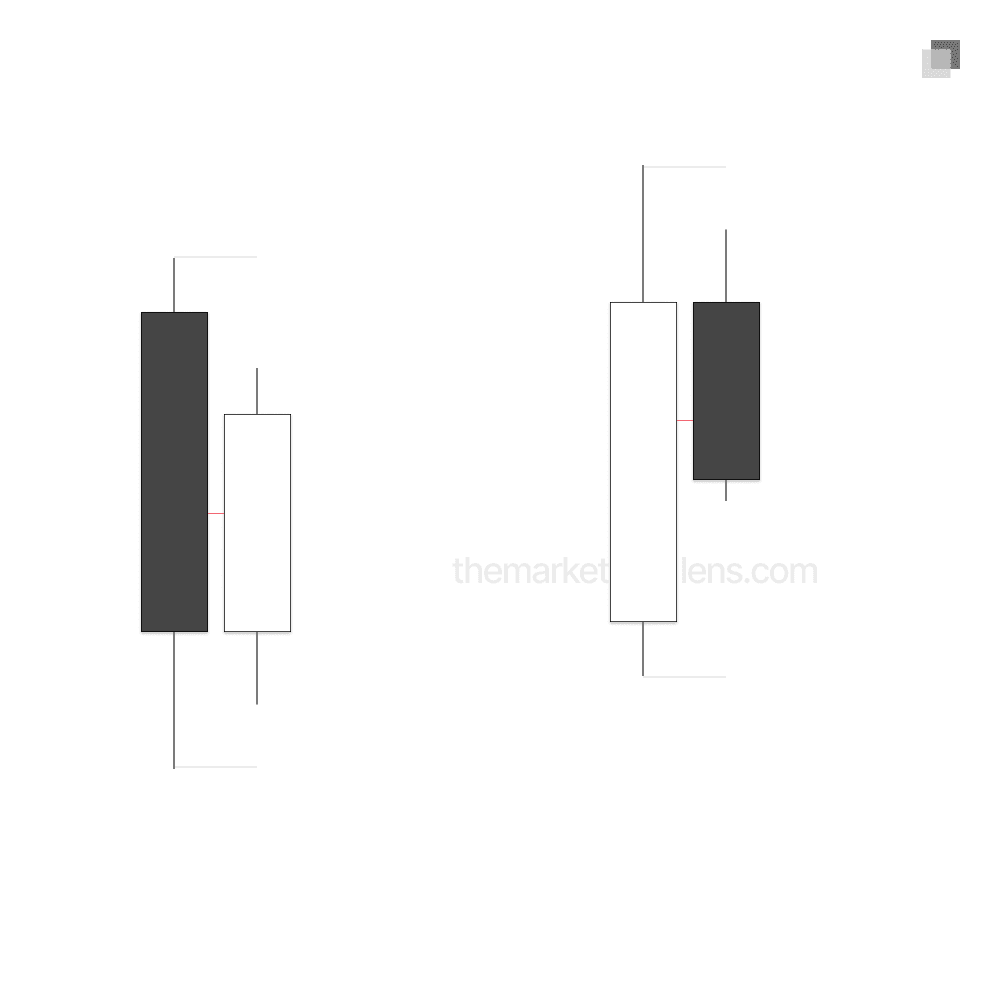

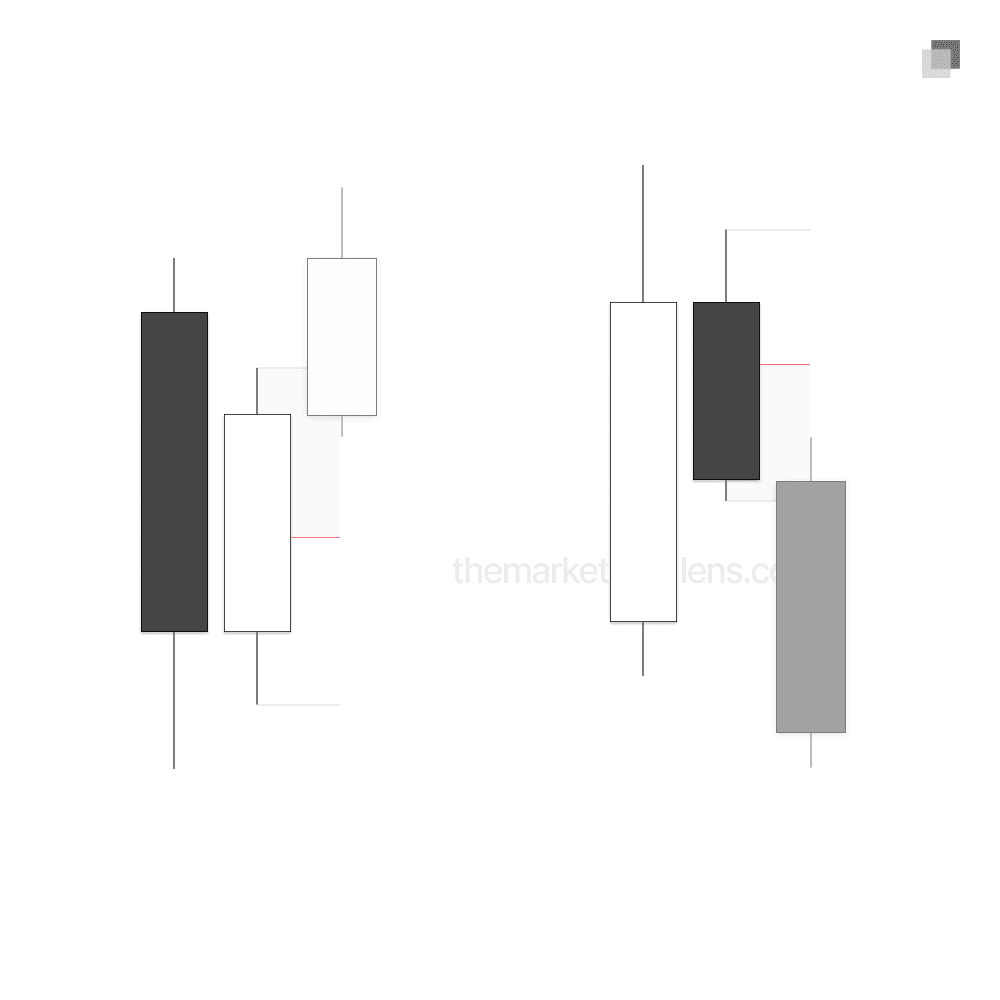

Here you can see that price remains as an inside bar, respecting the EQ while also forming a full body candle. Since it stayed in respect to the EQ, a continuation can be anticipated. Because price closed with a full body, the entire candle’s range can be used as the reference for continuation.

Here you can see that price remains as an inside bar, respecting the EQ while also forming a full body candle. Since it stayed in respect to the EQ, a continuation can be anticipated. Because price closed with a full body, the entire candle’s range can be used as the reference for continuation.

Here you can see that price remains as an inside bar, respecting the EQ while also forming a full body candle. Since it stayed in respect to the EQ, a continuation can be anticipated. Because price closed with a full body, the entire candle’s range can be used as the reference for continuation.

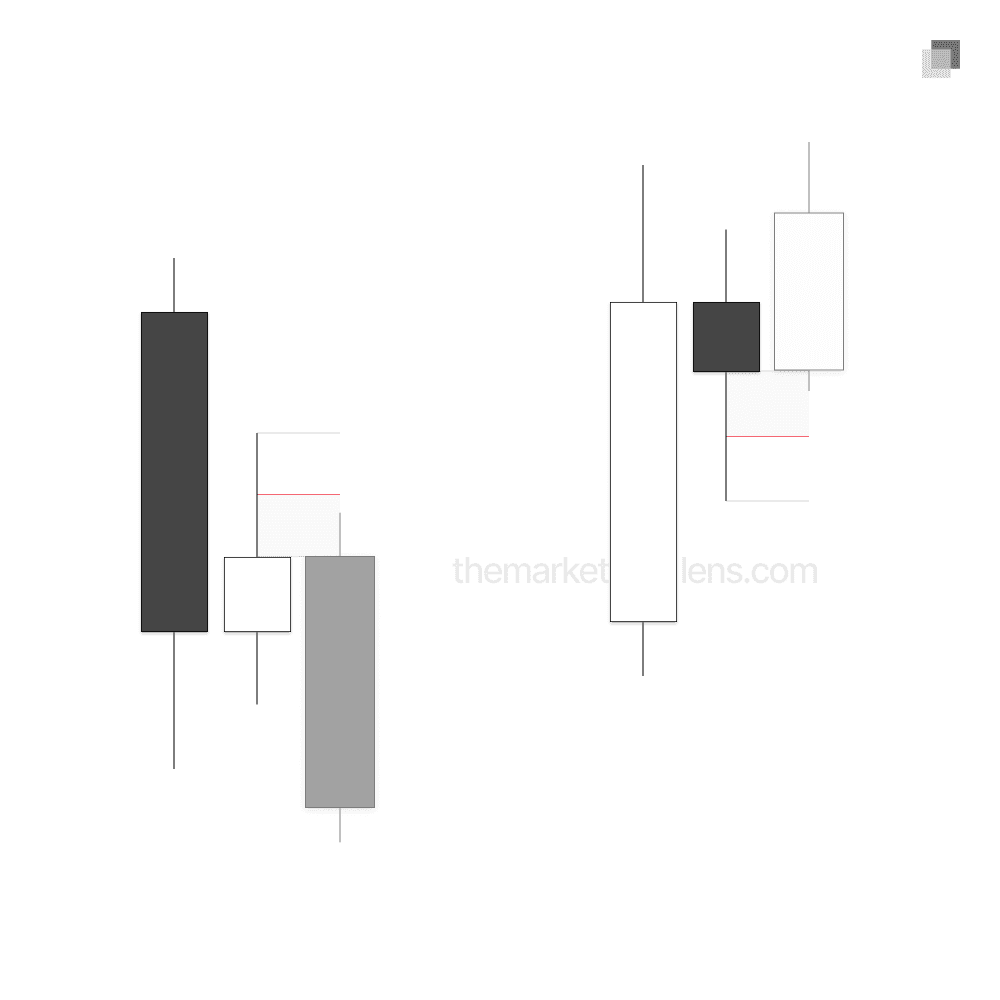

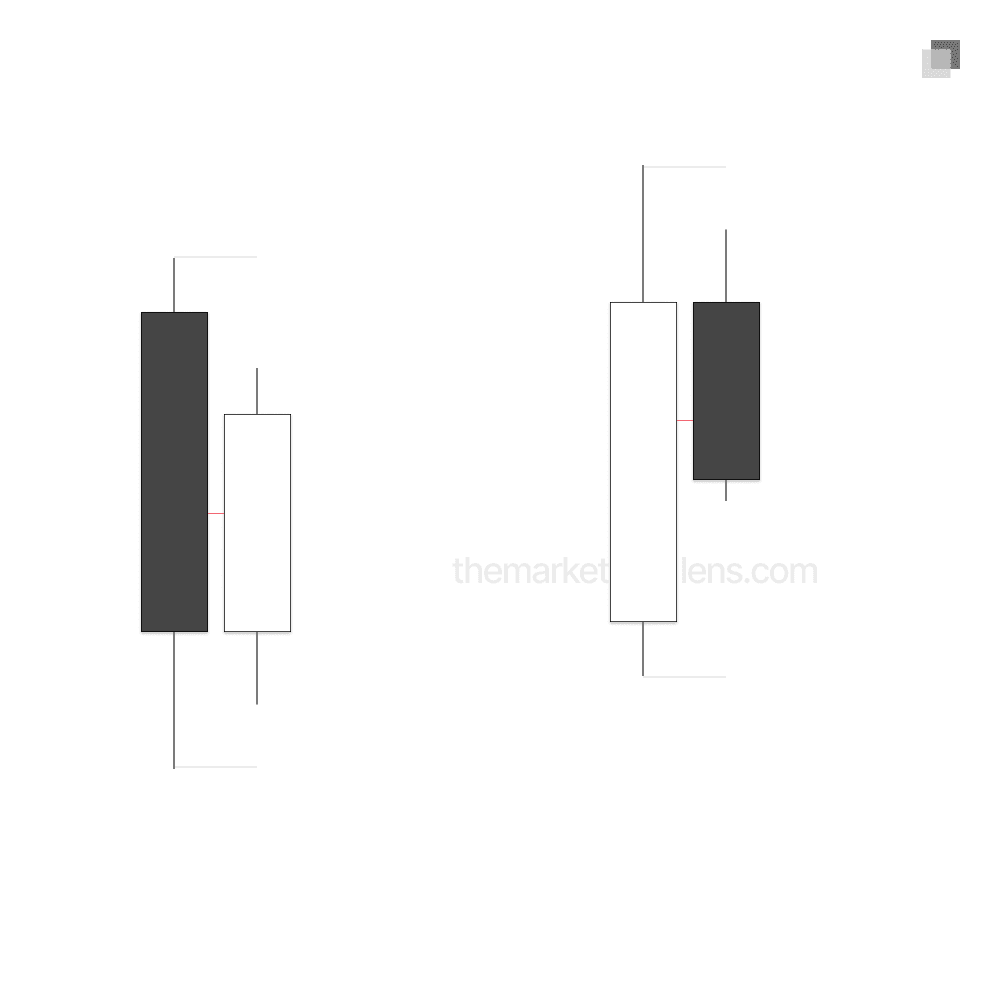

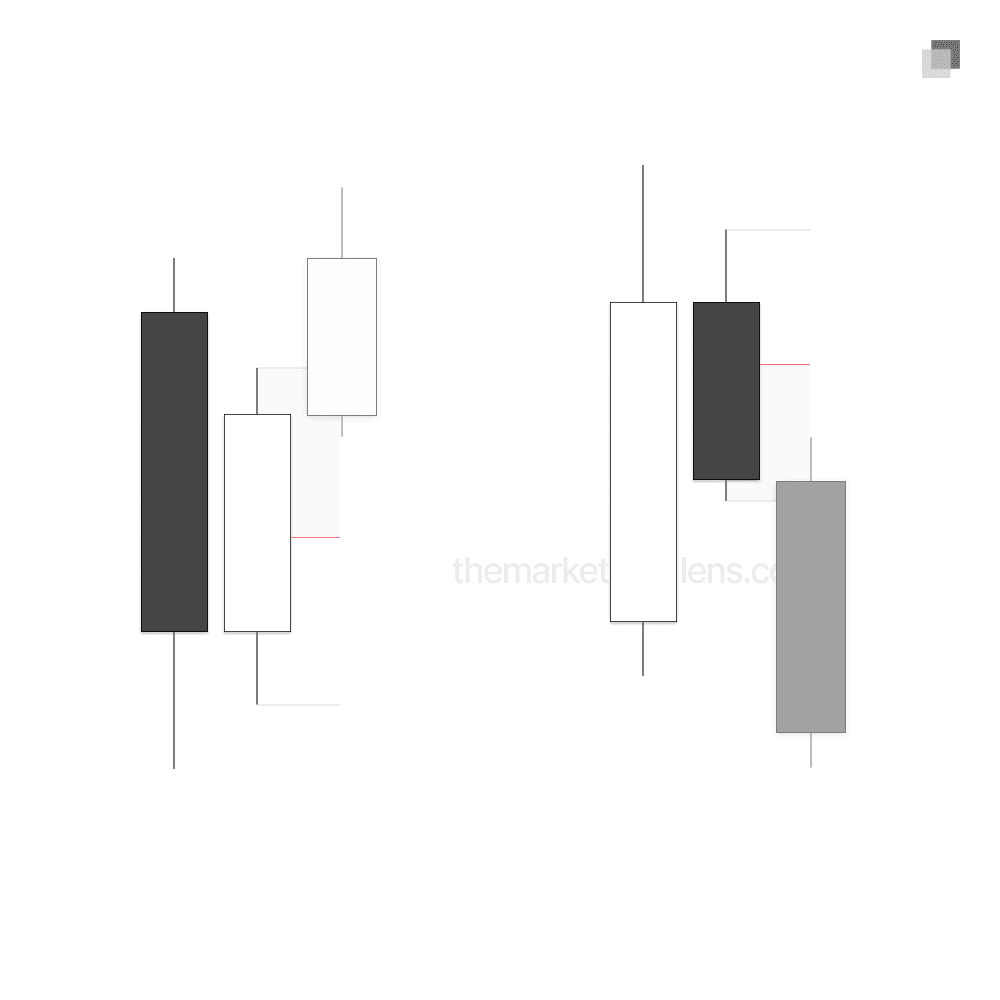

Here you can see that price does not remain in respect to the previous candle’s equilibrium. With this closure through the EQ, a reversal is anticipated, and price can be expected to continue in the opposite direction, using the EQ of the previous day’s candle as the reference point.

Here you can see that price does not remain in respect to the previous candle’s equilibrium. With this closure through the EQ, a reversal is anticipated, and price can be expected to continue in the opposite direction, using the EQ of the previous day’s candle as the reference point.

Here you can see that price does not remain in respect to the previous candle’s equilibrium. With this closure through the EQ, a reversal is anticipated, and price can be expected to continue in the opposite direction, using the EQ of the previous day’s candle as the reference point.

The standard for trading education and guidance

2025 The Market Lens - All Rights Reserved

The standard for trading education and guidance

2025 The Market Lens - All Rights Reserved

The standard for trading education and guidance